|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Wall Street Bullish or Bearish on Ameriprise Financial Stock?/Ameriprise%20Financial%20Inc%20HQ%20sign-%20by%20Wolterk%20via%20iStock.jpg)

Valued at a market cap of $48.9 billion, Ameriprise Financial, Inc. (AMP) is a diversified financial services company operating in the United States and internationally. The firm provides financial planning, investment management, and insurance solutions through its Advice & Wealth Management, Asset Management, and Retirement & Protection Solutions segments. The Minneapolis, Minnesota-based company's shares have outperformed the broader market over the past 52 weeks. AMP stock has increased nearly 18% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.2%. However, shares of the company are down 2.7% on a YTD basis, lagging behind SPX’s 10.2% gain. Looking closer, the financial services company stock has underperformed the Financial Select Sector SPDR Fund’s (XLF) over 20% return over the past 52 weeks.

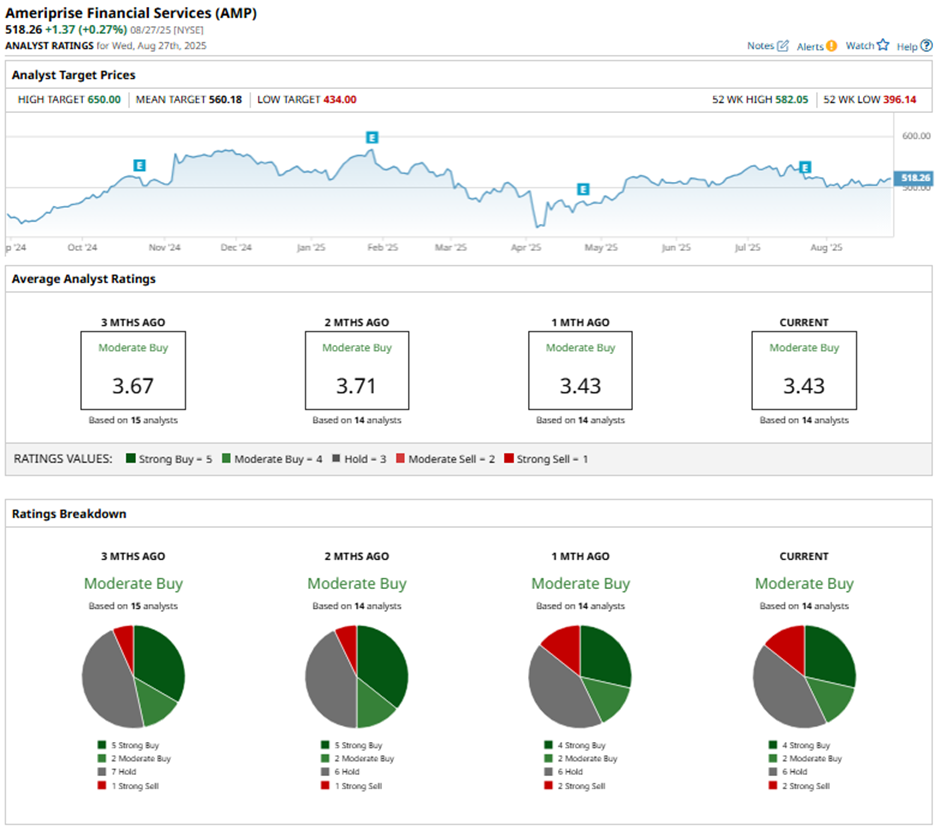

Despite Ameriprise posting better-than-expected Q2 2025 adjusted EPS of $9.11, shares fell 3.7% on Jul. 24 as investors focused on weak client flows. Total client net flows dropped 35% to $4.3 billion, with wrap net flows down 28% to $5.4 billion. The Advice & Wealth Management segment also saw margin compression to 29%, overshadowing record client assets of $1.1 trillion and AUMA of $1.6 trillion. For the fiscal year ending in December 2025, analysts expect Ameriprise Financial’s adjusted EPS to grow 9.8% year-over-year to $37.73. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion. Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings, two “Moderate Buys,” six “Holds,” and two “Strong Sells.”

This configuration is slightly less bullish than three months ago, with five “Strong Buy” ratings on the stock. On Jul. 28, BofA analyst Craig Siegenthaler cut Ameriprise’s price target to $581 while maintaining a “Buy" rating. The mean price target of $560.18 represents an 8.1% premium to AMP’s current price levels. The Street-high price target of $650 suggests a 25.4% potential upside. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|