|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Are Wall Street Analysts Bullish on Teledyne Technologies Stock?/Teledyne%20Technologies%20Inc%20website%20and%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

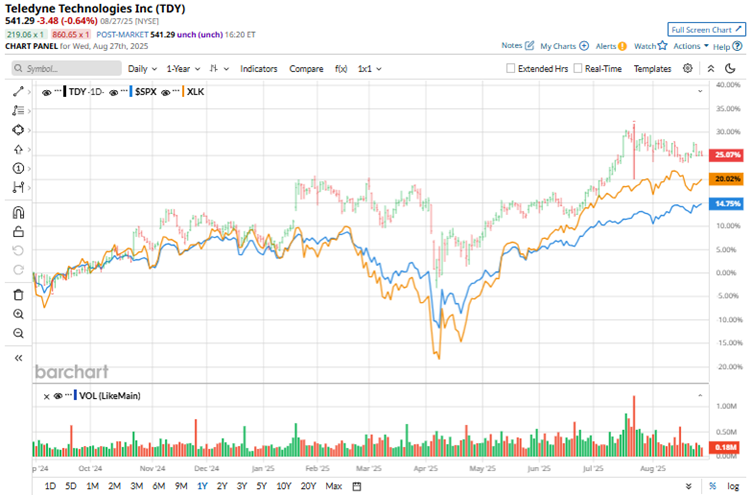

Teledyne Technologies Incorporated (TDY), based in Thousand Oaks, California, is a multifaceted industrial firm specializing in high-tech markets. Its operations span a wide range of sectors, including digital imaging, aerospace, defense electronics, and advanced instrumentation. The company delivers cutting-edge products, including sensors, imaging systems, and monitoring equipment, often designed for use in challenging environments. Teledyne supports industries like marine research, environmental analysis, and space exploration. With a strong global presence and an emphasis on innovation, Teledyne continues to grow through acquisitions and technological advancements, serving both commercial and government clients with dependable, high-performance solutions. The company has a market capitalization of $25.54 billion. Over the past 52 weeks, the company’s stock has held up strong, surging by 27.2%, while it is also up by 16.6% year-to-date (YTD). The stock has broadly outperformed the S&P 500 Index ($SPX), which has gained 15.2% and 10.2% over the same periods, respectively. Turning our focus to the company’s own tech sector, we see that the stock has been an outperformer here as well, as the Technology Select Sector SPDR Fund (XLK) is up by 18.9% over the past 52 weeks and 13.7% YTD.

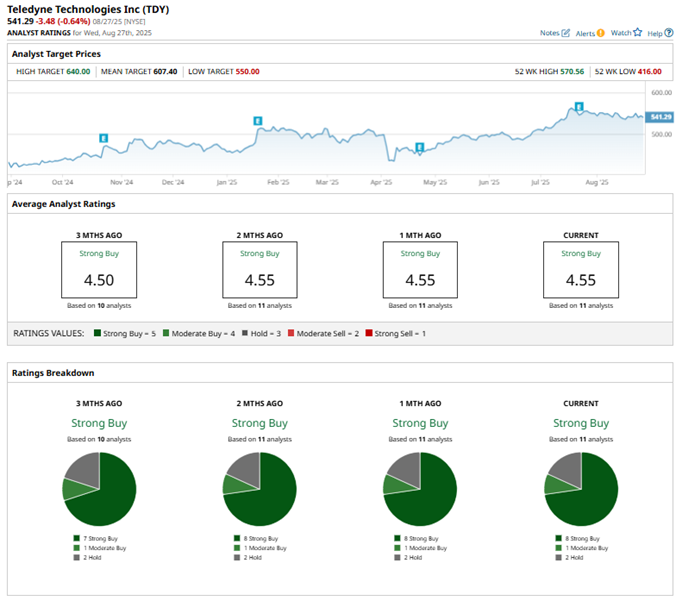

On July 23, Teledyne reported solid second-quarter results for fiscal 2025. The company’s revenue increased 10.2% year-over-year (YOY) to a record quarterly sale of $1.51 billion. Teledyne reported that it had achieved the most outstanding total and organic sales growth in three years. Its non-GAAP EPS also increased by 13.5% from its year-ago value to $5.20, which was higher than the $5.02 that Wall Street analysts were expecting. Due to the robust results, the stock reached a 52-week high of $570.56 on July 23, but is down 5.1% from this high. For the fiscal year 2025, ending in December 2025, Wall Street analysts expect Teledyne’s EPS to grow 8.7% YOY to $21.44 on a diluted basis, and increase by 11.2% to $23.84 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all of the trailing four quarters. Among the 11 Wall Street analysts covering Teledyne’s stock, the consensus is a “Strong Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” and two “Hold” ratings. The configuration of the ratings is more bullish than it was three months ago, with eight “Strong Buy” ratings now, up from the previous seven.

After its Q2 results, UBS analyst Damian Karas maintained a “Buy” rating on the stock, while raising the price target from $585 to $630, reflecting a positive outlook. Citing the same reason, analysts at Needham maintained their “Buy” rating on Teledyne, while raising the price target from $550 to $585. Teledyne’s mean price target of $607.40 indicates a 12.2% upside over current market prices. The Street-high price target of $640 implies a potential upside of 18.2%. On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|