|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Are Wall Street Analysts Predicting Axon Enterprise Stock Will Climb or Sink?/Axon%20Enterprise%20Inc%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $60.4 billion, Axon Enterprise, Inc. (AXON) develops and sells conducted energy devices under the TASER brand, along with body cameras, software, and digital evidence management solutions for public safety. The company serves law enforcement, federal, corrections, healthcare, retail, and personal safety markets worldwide. Shares of the Scottsdale, Arizona-based company have significantly outperformed the broader market over the past 52 weeks. AXON stock has jumped 112.7% over this time frame, while the broader S&P 500 Index ($SPX) has returned 15.2%. Moreover, shares of the company are up 29.7% on a YTD basis, compared to SPX’s 10.2% rise. Focusing more closely, the TASER maker stock has also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 19.1% increase over the past 52 weeks and a 16.8% YTD gain.

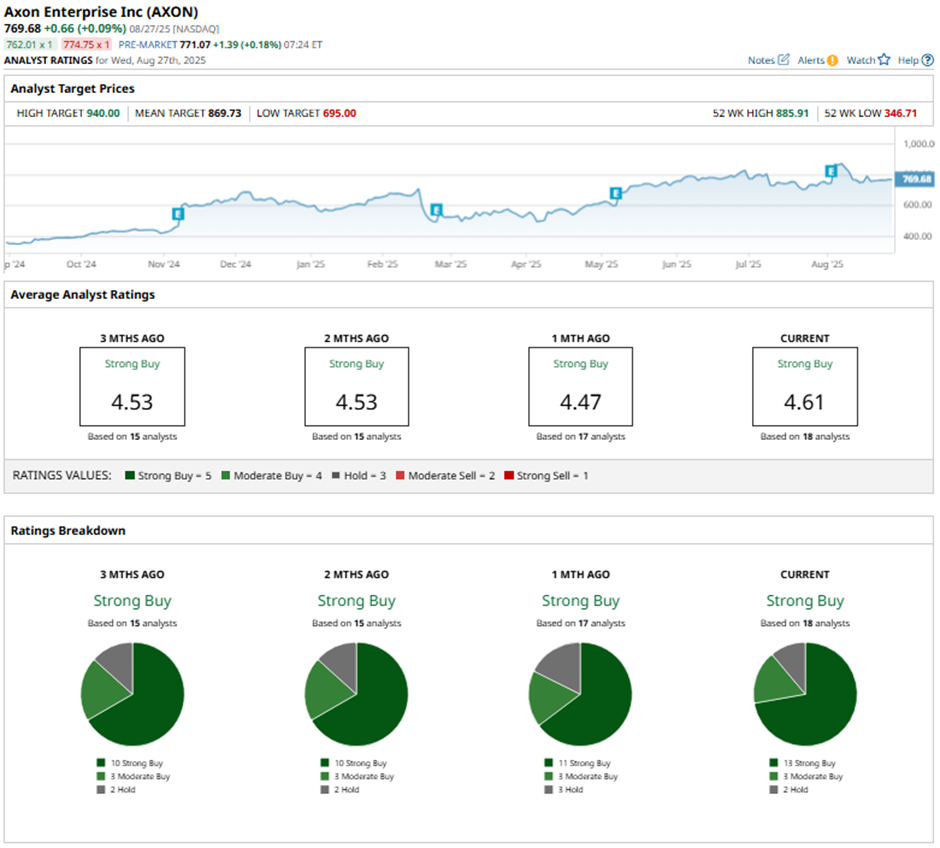

Shares of Axon jumped 16.4% following its Q2 2025 results on Aug. 4 as adjusted EPS came in at $2.12, exceeding Wall Street estimates. Revenue rose to $668.5 million, beating expectations and reflecting strong demand for TASER devices, body cameras, and software solutions. The company also raised its full-year 2025 revenue forecast to $2.65 billion - $2.73 billion, signaling confidence in continued growth from federal spending and executive security demand. For the fiscal year ending in December 2025, analysts expect Axon Enterprise’s EPS to decline 54.6% year-over-year to $0.95. The company's earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters while missing on two other occasions. Among the 18 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 13 “Strong Buy” ratings, three “Moderate Buys,” and two “Holds.”

This configuration is more bullish than three months ago, with 10 “Strong Buy” ratings on the stock. On Aug. 5, Northland analyst Michael Latimore raised Axon’s price target to $800 with an “Outperform” rating. The mean price target of $869.73 represents a nearly 13% premium to AXON’s current price levels. The Street-high price target of $940 suggests a 22.1% potential upside. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|