|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

How Is Alexandria Real Estate’s Stock Performance Compared to Other Real Estate Stocks?

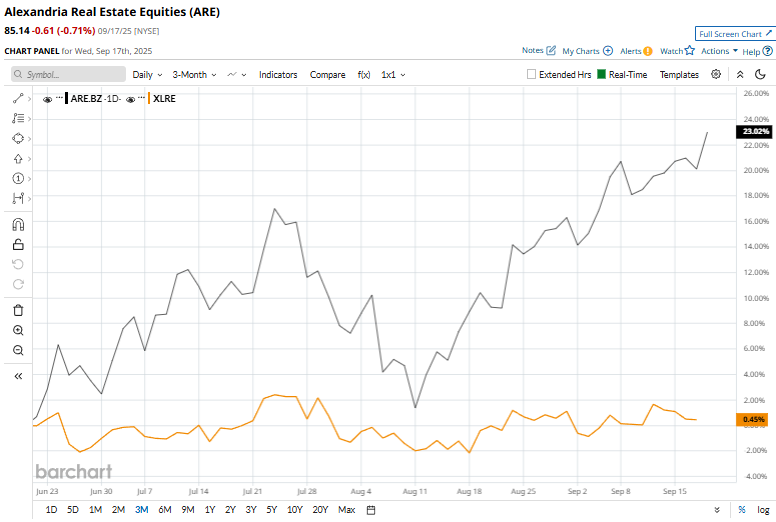

Valued at $12.3 billion by market cap, Alexandria Real Estate Equities, Inc. (ARE) is a leading U.S. REIT specializing in Class A/A+ lab and office campuses for life sciences, biotech, and agtech companies. Founded in 1994 and headquartered in Pasadena, California, it owns and develops properties in top innovation clusters, including Boston, San Francisco, San Diego, Seattle, and the Research Triangle. Companies worth $10 billion or more are generally described as “large-cap stocks,” and ARE perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the REIT industry. Its niche focus on lab space, which is complex to build and less affected by remote work trends, combined with high-barrier markets, long-term leases, and strong tenant demand, provides stable cash flows and growth opportunities. Despite its notable strength, ARE slipped 32.2% from its 52-week high of $125.60, achieved on Sept. 25, 2024. Over the past three months, ARE stock declined 19.6%, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) marginal losses during the same time frame.

In the longer term, shares of ARE dipped 12.7% on a YTD basis and fell 31.3% over the past 52 weeks, significantly underperforming XLRE’s YTD gains of 3.3% and 6.6% drop over the last year. ARE has been trading above its 50-day moving average since mid-June but has remained below its 200-day moving average for the past year.

On July 21, ARE reported its Q2 results, and its shares rose 1.3%. Its total revenues slipped slightly year-over-year to $762 million but still came in ahead of Wall Street’s estimate of $750.6 million. Similarly, its FFO declined 1.3% to $2.33 per share, yet this figure also surpassed analysts’ expectations of $2.29 per share. In the competitive REIT area, Kilroy Realty Corporation (KRC) has taken the lead over ARE, showing resilience with an 8.1% uptick on a YTD basis and a 13.7% rise over the past 52 weeks. Wall Street analysts are moderately bullish on ARE’s prospects. The stock has a consensus “Moderate Buy” rating from the 13 analysts covering it, and the mean price target of $97.50 suggests a potential upside of 14.5% from current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|