|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Kellanova Stock Underperforming the Nasdaq?

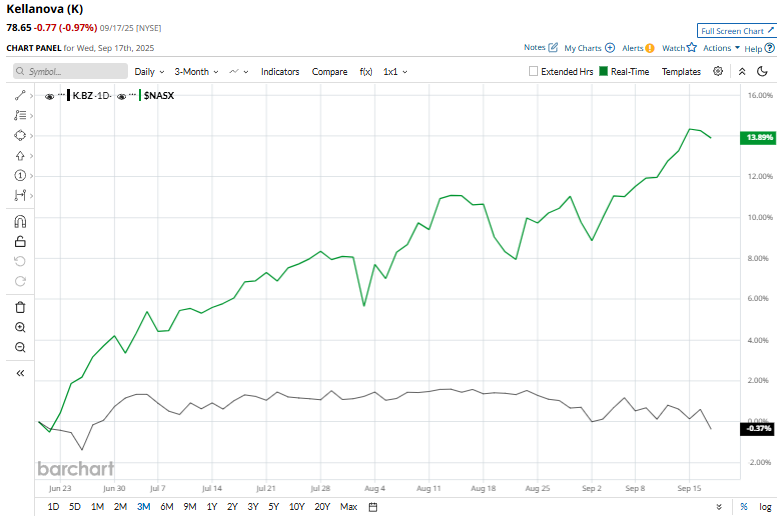

Valued at $27.6 billion by market cap, Kellanova (K) is a global snacking and food company formed in October 2023 following the Kellogg Company’s split, retaining brands such as Pringles, Cheez-It, Pop-Tarts, Eggo, Special K, and MorningStar Farms. Headquartered in Chicago, it operates in over 180 countries. Companies worth $10 billion or more are generally described as “large-cap stocks,” and Kellanova perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the packaged goods industry. Kellanova’s well-known brands give it a strong market presence and consumer loyalty, while its manufacturing in 20 countries and reach across 180+ markets provide global diversification and reduce reliance on any single economy. K currently trades 5.5% below its 52-week high of $83.22, achieved on Mar. 4. Over the past three months, K stock declined 2%, underperforming the broader Nasdaq Composite’s ($NASX) 14% rise over the same time frame.

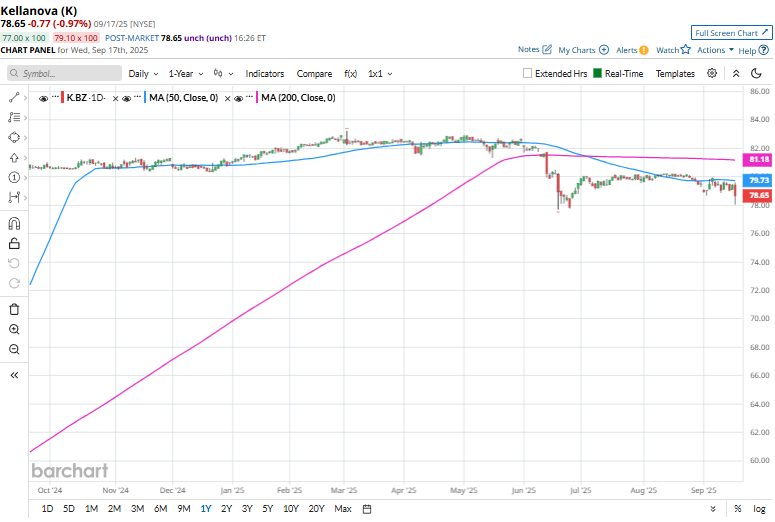

In the longer term, shares of K dipped 2.9% on a YTD basis, underperforming $NASX’s YTD gains of 15.3%. Additionally, the stock has decreased 2.5% over the past 52 weeks, lagging behind $NASX’s 26.3% returns over the last year. K has been trading below its 50-day and 200-day moving averages since mid-June, indicating a downtrend.

Kellanova posted mixed Q2 results on July 31, leaving its stock largely unchanged in the following session. While overall revenues remained pressured by soft industry demand, stronger performance in emerging markets provided a lift, helping sales inch up 0.3% year-over-year to $3.2 billion and narrowly beat expectations. On the downside, adjusted operating income fell 5% to $477 million, and adjusted EPS declined 6.9% to $0.94, falling below consensus estimates. K’s rival, General Mills, Inc. (GIS) shares lagged behind the stock, declining 22.9% on a YTD basis and 34% over the past 52 weeks. The stock has a consensus “Hold” rating from the 14 analysts covering it, and the mean price target of $83.42 suggests a potential upside of 6.1% from current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|